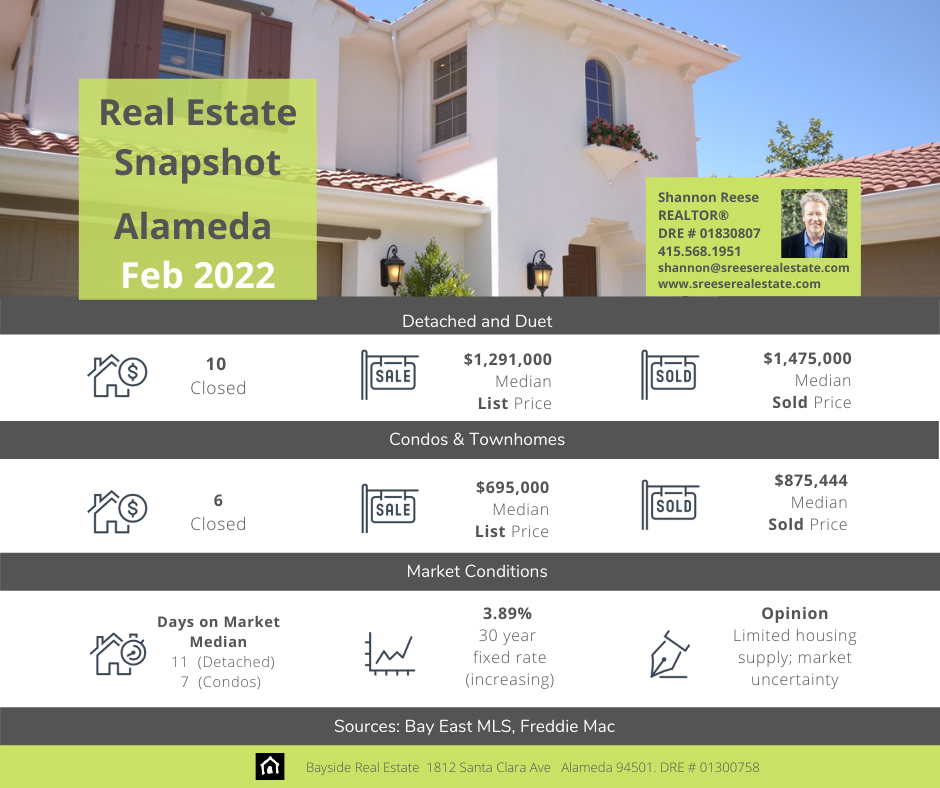

We created the Alameda real estate market snapshot to keep you informed and put the latest real estate market data at your fingertips. Our goal is to help you make the best decision for yourself and your loved ones. Here’s our latest analysis:

March vs. February

There were about 44% fewer total closed sales in March than in February (9 versus 16). A continued drop from January’s much larger total sales of 23 closed properties. What’s going on?

Local Market News

On the positive side, unemployment across the US has fallen to 3.6% and here in the Bay Area, unemployment is just 2.9%. With all the jobs, and money percolating around in the economy, there is still a lot of confidence in the local housing market. Housing inventory continued to be sparse and closed prices decreased about 1.7% for homes in Alameda with a median sold price of $1,450,000 (about $25,000 less than Feb), however, closed prices told a different story for condos and townhouses. Their sales price rose just shy of 6% with a median sold price of $925,000 versus $875,444, a difference of almost $50,000. Again, the market appears to be holding up well, in spite of all the potential challenges it faces for now.

Challenges

The Russian invasion of Ukraine moved into its second month and has caused heartfelt anguish, widely felt political turmoil, and has also caused gas prices to skyrocket. Layer on top of this inflation which hit 8.5%, which hasn’t been this high since December 1981. In addition, interest rates began to move much higher, up a full point from February, but have yet to begin taking some of the shine off the housing market, in both the Bay Area and across the nation. Time will tell if buyers’ mood towards housing changes. Are people still buying? Yes. Although, it will get a bit harder to afford property because of higher interest rates.

Are people still selling? Yes. A bright spot is that the days on the market remained the same from last month to March. The median days on the market (DOM) for detached and duet homes was 11, with condos and townhomes selling within 10 days. Condo demand appears poised to hold up, especially as it remains a more affordable entry point into homeownership.

Expectations

April should begin to see more inventory coming on the market, giving buyers a bit more choice. Covid restrictions have all eased, even though there is a new variant that could cause issues in the future. Rents have really begun to take off which may end up helping the sales market. As always, people will weigh their options and do what’s best for themselves.

This year is going to be filled with uncertainty, but lately that seems to have become the norm. Demand here has remained strong and steady, yet we haven’t really felt the impact of higher interest rates. The lack of inventory will likely continue to be one of the main factors affecting buyers.

Next month: April

Check back again next month as we bring you the latest data and opinions that we’re seeing in real estate. Our goal is to stay on top of trends and data to help you make the best decision possible for you and your loved ones.

Got a question? Whether it’s about what your home may be worth or how you can buy your next home, just give me a shout.